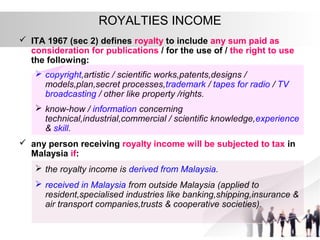

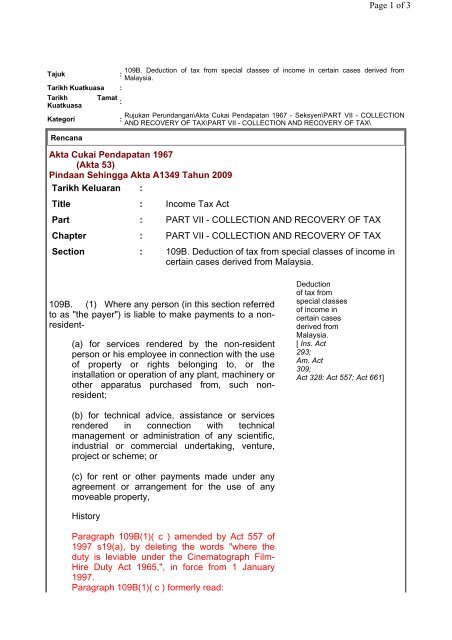

Income that a non-resident derives from Malaysia from special classes of income is subject to tax in Malaysia. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax.

How To File Income Tax For The First Time

However if you claimed RM13500 in tax.

. The page is not found. A tax rebate reduces the amount of tax charged there are currently four types of. Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017.

The prevailing WHT rate is 10 except where a lower rate is provided in an. LAWS OF MALAYSIA Act 833 FINANCE ACT 2021 An Act to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 the Stamp Act 1949 the Petroleum Income Tax Act 1967. INCOME TAX ACT 1967 Click here to see Annotated Statutes of this Act Part I PRELIMINARY SECTION 1Short title and commencement 2Interpretation Part II IMPOSITION AND GENERAL.

The following are some tax penalties depending on the offence committed. Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and. Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for practitioners to use in the courtroom handy as a desk or portable reference and reliable as a student text.

B Gains profit from employment. RM 18000 Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for practitioners to use in the courtroom handy as a desk or portable reference and. A qualified person defined who is a knowledge worker residing in.

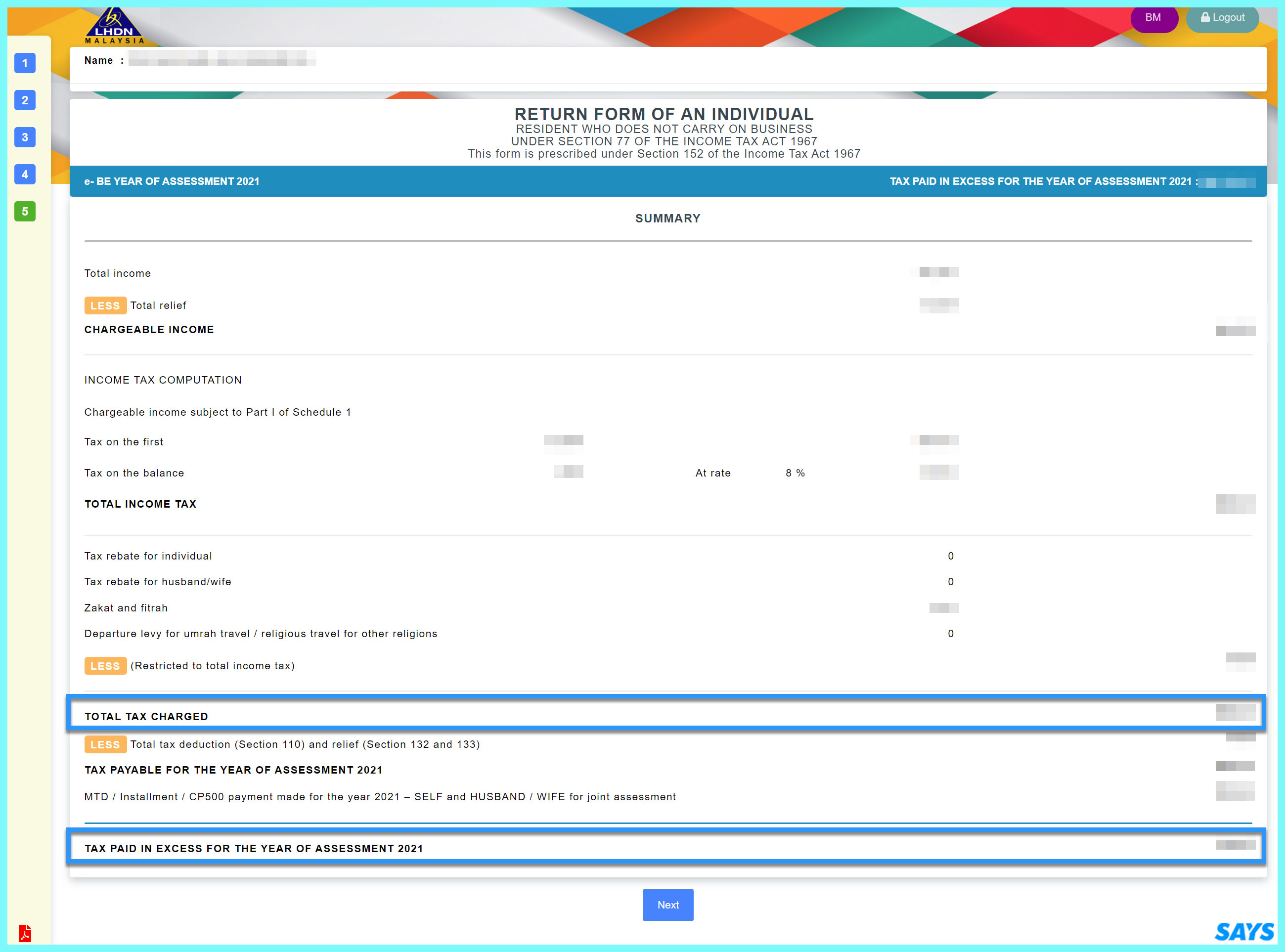

Based on this amount the income tax to pay the government is RM1640 at a rate of 8. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or. 2 This Act shall extend throughout Malaysia.

3 This Act shall have effect for the year of assessment 1968 and. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. 1 This Act may be cited as the Petroleum Income Tax Act 1967.

This page is currently under maintenance. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from Malaysia or received in Malaysia from outside.

This booklet also incorporates in coloured italics the 2023. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. A Gains profit from a business.

13 rows Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable income. To inform IRBM the. Read a January 2022 report prepared by the KPMG member.

C Dividends interest or discounts. Capital allowances and losses unabsorbed have to be utilised during the exemption period and. Dividends paid out of tax-exempt income to shareholders will also be exempted from tax.

Tax is imposed annually on individuals who receive income in respect of. Failing to furnish income tax return. Employers Responsibility - Malaysia Income Tax Act Employers Responsibility under the Income Tax Act Key Takeaway To inform IRBM any new employee within 30 days.

Some Tax Penalties in Malaysia You May Not Be Aware of. January 4 2022 The Finance Act 2021 was published 31 December 2021 and the effective date is 1 January 2022. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable.

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment Semantic Scholar

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Re Extension Of The 100 Income Tax Exemption Under Section 54a Of The Income Tax Act 1967 Masa Malaysia Shipowners Association

Income Tax Act Malaysia Savannagwf

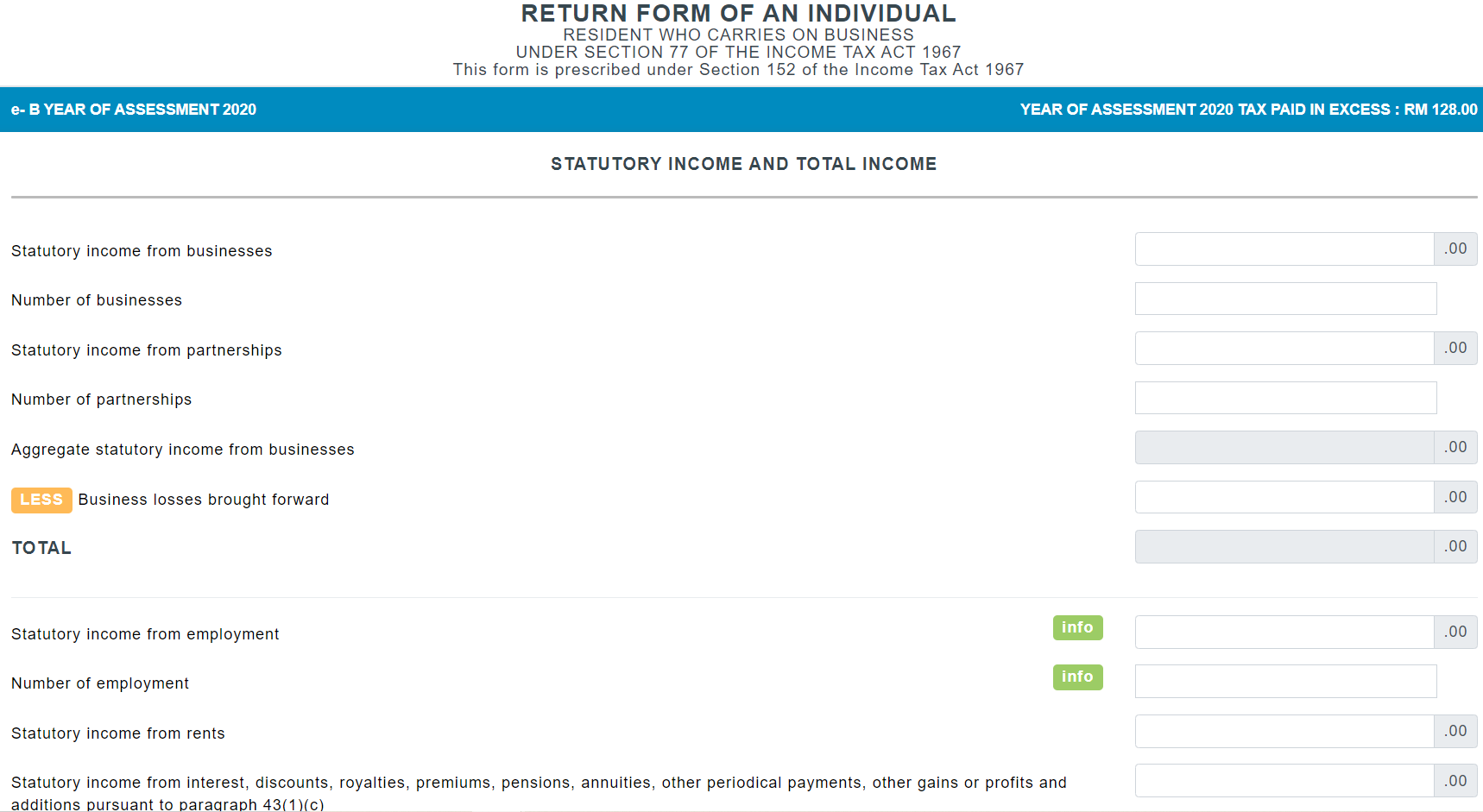

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysian Tax Issues For Expats Activpayroll

Taxation Principles Dividend Interest Rental Royalty And Other So

Comprehensive Malaysia Data Retention Schedule Data Retention Schedule Filerskeepers

Be Tax Confident Operational Guideline No 3 2020 Penalties Under Section 112 3 Income Tax Act 1967 Section 51 3 Petroleum Income Tax Act 1967 And Section 29 3 Real Property Gains Tax 1976 To Download

Books Kinokuniya Income Tax Act 1967 With Complete Regulations And Rules 6th Edition 9789670853161

Income Tax Act 1967 Hobbies Toys Books Magazines Textbooks On Carousell

Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 5th April 2018 Mphonline Com

Income Tax Everything They Should Have Taught Us In School The Full Frontal

109b Deduction Of Tax From Special Classes Of Income In Certain

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia